Athens, November 14-15, 2024

The 11th Athens Edition of the DDC Investor Summit brought together industry leaders from over 20 jurisdictions, spotlighting trends in distressed assets, private debt, and the transformative impact of technology on NPL management.

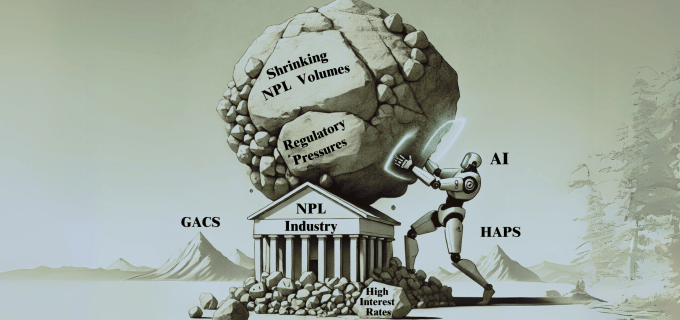

Market Consolidation and Regulatory Pressures

The European NPL market is experiencing significant consolidation, driven by a stable economic climate, improved loan quality, and reduced volumes of new NPL stock entering the market. Regulatory pressures, particularly stemming from the EU NPL Directive, are also reshaping the market. Greece, Italy, and Spain show emerging trends in higher emerging servicer concentration and specialization, signaling a transition toward improved efficiency and sustainable profitability. As the market matures, further consolidation and specialization are expected to redefine industry dynamics.

Technological Advancements

AI-driven solutions were a focal point at the summit, demonstrating their transformative role in the NPL sector. These technologies are enhancing due diligence processes and streamlining data analysis, meeting the growing demand for operational efficiency. However, the sector remains in its early stages of AI adoption, leaving significant opportunities for advanced, value-adding solutions to drive productivity and improve outcomes for market participants.

Reperforming Assets: A Strategic Shift

Reperforming assets (RPLs) were highlighted as a growing area of interest. With the maturation of the NPL market, RPLs are increasingly seen as a means to enhance liquidity, particularly for banks. However, their integration poses regulatory operational, data and valuation challenges, necessitating robust frameworks to balance opportunity and oversight. Lessons from other jurisdictions provide valuable insights into managing these transitions effectively.

Future Opportunities

As the market consolidates and specialization deepens, rethinking legacy practices and embracing efficient, technology-driven operations will be critical. The combination of market expertise with cutting-edge technological solutions is now more valuable than ever. Opportunities lie in leveraging AI to optimize processes, refining frameworks for reperforming assets, and navigating the evolving regulatory landscape to unlock sustainable growth.

NPL Markets Stance

At NPL Markets, staying ahead of the curve means delivering cutting-edge solutions tailored to market needs. We are dedicated to continuously monitoring industry trends and technological advancements to ensure our offerings remain innovative and relevant. Explore the latest market insights, technological developments, and NPL Markets’ perspectives in our news and research articles at https://nplmarkets.com.

Find out more in our most recent articles on AI & Securitized Risk Transfer (SRT):

AI:

AI Use Cases for NPL Market Development

Navigating the Landscape of Large Language Models (LLMs)

Enhancing Recovery Rate Predictions with Machine Learning

SRT:

Operational Challenges for Significant Risk Transfer in Europe

Insights from the SCI Workshop on Significant Risk Transfer